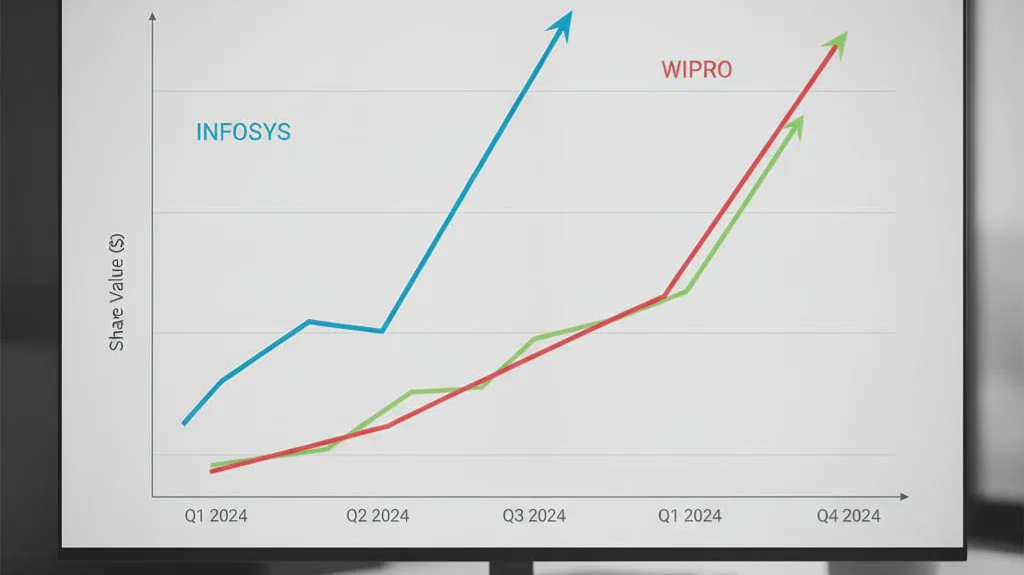

The mixed results highlight the contrasting performance of the two major Indian IT companies, Infosys and Wipro, in their second quarter (Q2 FY26)

Infosys: Announces a surge in revenue of approximately 2.9 percent or $5 billion (up by 3.7 percent YoY). The company witnessed a major increase in net profit, up over 13 percent YoY, along with a major deal with a contract value of $3.1 billion.

Wipro: The IT firm did report a strong booking in total, but the immediate revenue was impacted. Wipro’s revenue declined by 2.6 percent, or $2.6 billion (down by 2.1 percent YoY), however, on a Quarter-on-Quarter (QoQ) basis, their revenue grew slightly, 0.3 percent approximately. The net profit of the firm was significantly flat, with a rise of just 1.2 percent.

Context for the differences in Infosys and Wipro

Low demand environment: Clients of both the companies reduced or postponed their purchase of services, amid the ongoing tariff uncertainties and cost-cutting are the major causes for this decline in demand, however Infosys left Wipro behind in terms of growth.

Infosys’s reliance: Infosys cracked a major deal of rupees 14,000 crore with NHS (National Health Service, publicly funded healthcare system for the United Kingdom) relating to artificial intelligence, and their growth driven by good performance in various segments like manufacturing and financial services, which forecasts a higher confidence in their outlook.

Wipro’s challenges: The company’s revenue was significantly impacted by the challenging market. Wipro saw the major impact on its margins due to an unrecovered bad debt amounting to $13.1 million. However, they saw a sequential growth in few segments but these have yet to reflect into revenue growth.

Market reaction: Despite Infosys’s better performance, both companies’ American Depository Receipts (ADRs) and domestic shares saw a mixed or negative reaction, which reflected the overall sentiment of the IT sector.