5 September Friday:

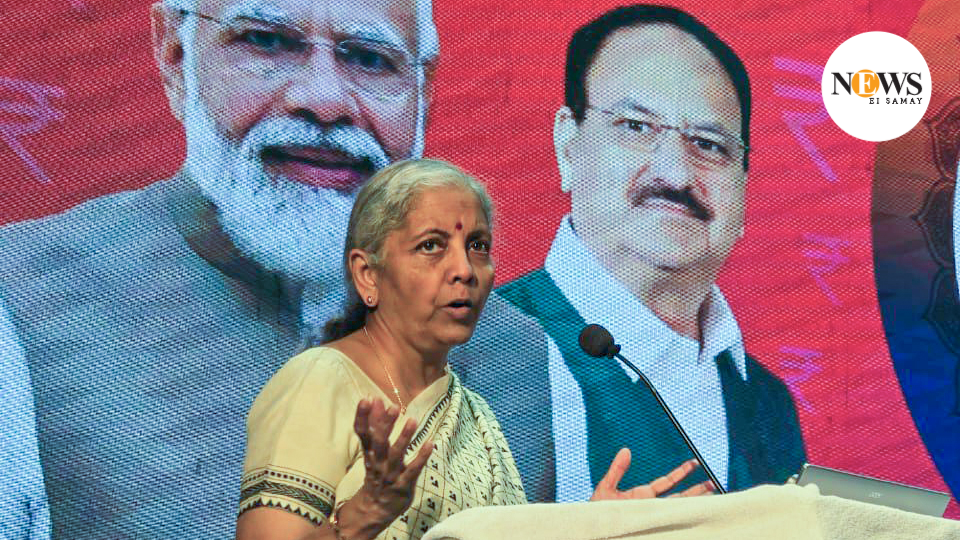

Finance Minister Nirmala Sitharaman has criticized the Congress party for trying to take credit for the recent Goods and Services Tax (GST) reforms, pointing out that the same party had ridiculed the tax in the past as the "Gabbar Singh Tax."

India Today reported that Sitharaman stated, "Those who once mocked GST as a Gabbar Singh Tax are now keen to take credit for it.". The Congress must inform us why it was not able to introduce it during its term. She also emphasized that during the regime of former Prime Minister Indira Gandhi, India had some of the most stringent taxation regimes in the world. "In those days, if one was earning ₹100, ₹91 would be gone as taxes. Those who used to levy 91% tax are now attempting to claim credit for GST," she said.

The jibe was made a day after the GST Council had cleared in a unanimous decision a significant reform, the rationalization of tax slabs to 5% and 18%. The step is likely to reduce prices of such day-to-day essentials as toothpaste, butter, and soaps, besides consumer durables such as air conditioners and TV sets.

What is "Gabbar Singh Tax"?

Congress leader Rahul Gandhi came up with the term shortly after the introduction of the GST in 2017. He criticized the new tax system's numerous tax slabs and compliance barriers, comparing it to the fear-mongering Gabbar Singh from Sholay. The statement, which represented opposition criticism of the complexity of the GST, swiftly became a political catchphrase.

Congress quickly countered that the reform had been prompted by their own proposals. Congress spokesperson Pawan Khera tweeted on Wednesday's decision, "When they finally have to act upon inputs from Rahul Gandhi, why do they do it with so much delay?

Sitharaman rubbished such assertions, presenting the reforms as a reflection of the government's resolve and not the opposition's vision. Her remarks underline the BJP's approach to not merely defend GST as a pet reform but also convert the opposition's own jibes into a counterpoint. With the new GST 2.0 model now in position, the political battle over credit appears to go on, with the ruling party hailing it as a governance achievement, and the Congress claiming it was only vindication of its persistent demand.