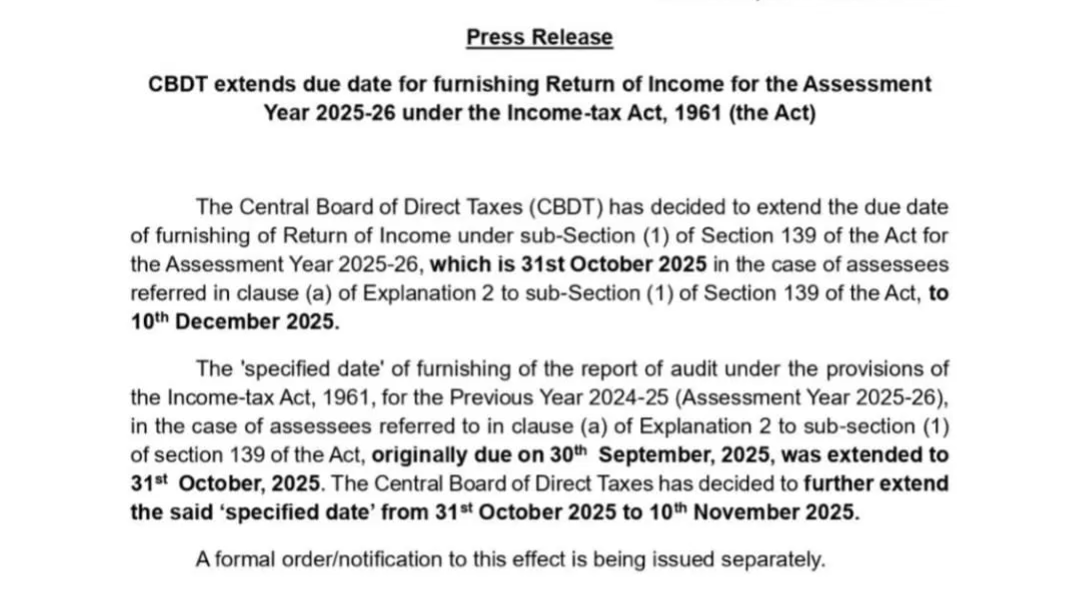

The Income Tax Department has extended the deadlines for filing tax returns and audit reports for the assessment year 2025-26. The Government of India's Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, have announced the extension of the deadlines in a press release issued on Wednesday.

Earlier, the final date for filing tax returns was set to be on 31 October 2025. This has been extended till 10 December 2025. The press release reads, "The Central Board of Direct Taxes (CBDT) has decided to extend the due date of furnishing of Return of Income under sub-Section (1) of Section 139 of the Act for the Assessment Year 2025-26, which is 31st October 2025 in the case of assessees referred in clause (a) of Explanation 2 to sub-Section (1) of Section 139 of the Act, to 10th December 2025."

The due date for filing the audit report has also been extended. Previously, the deadline for filing audit reports was 30 September, which was later extended till 31 October. The recent press release has highlighted the extension of the deadline once again for submitting the audit reports, which is going to be on 10th November.

The press release further added that, "The 'specified date' of furnishing of the report of audit under the provisions of the Income-tax Act, 1961, for the Previous Year 2024-25 (Assessment Year 2025-26), in the case of assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Act, originally due on 30th September, 2025, was extended to 31st October, 2025. The Central Board of Direct Taxes has decided to further extend the said 'specified date' from 31st October 2025 to 10th November 2025."

According to a Business Today report, on Tuesday, the Punjab and Haryana High Court, along with the Himachal High Court, issued directions to extend the income tax return filing deadline from 31 October to 30 November 2025, following the compilation of five writ petitions filed by tax associations and professionals. Earlier this month, the Gujarat Court passed a similar direction urging the Central Board of Direct Taxes to issue an extension for the entire country.