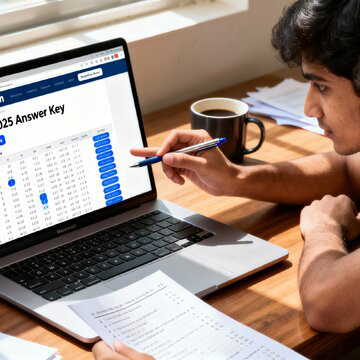

The Reserve Bank of India on Friday reduced the benchmark repo rate by 25 basis points to 5.25%, even as the rupee slipped to a record low below 90 against the US dollar and the economy continued to post strong growth.

The decision was taken at the end of the Monetary Policy Committee’s meeting held between December 3 and 5. The RBI also retained its neutral policy stance, indicating that future decisions will remain data dependent.

Also Read | India's big EV dream stalls as zero global automakers apply for key incentive scheme

A majority of the 44 economists surveyed by Bloomberg had expected the central bank to go ahead with the rate cut, as inflation remains well below the RBI’s medium-term target of 4%. However, the rupee’s sharp fall and India’s steady economic momentum had also raised the possibility of a pause.

Growth outlook raised, inflation forecast lowered

Along with the policy decision, the RBI revised its economic projections. The central bank raised India’s GDP growth estimate to 7.3%, from 6.8% earlier. It also lowered its inflation forecast for FY26 to 2%, from the previous estimate of 2.6%.

This suggests that price pressures remain subdued even as the economy continues to expand at a healthy pace.

Rupee weakness complicates policy path

As per a report by Hinduatan Times, RBI Governor Sanjay Malhotra had indicated last month that there was “definitely scope” for repo rate cuts after the central bank left the key rate unchanged in the previous two policy reviews.

Since then, the rupee has weakened sharply, breaching the 90 mark against the dollar earlier this week. The central bank has also shifted from actively defending the currency to allowing it greater flexibility amid uncertainty surrounding a possible India–US trade deal.

Also Read | Rupee hits historic all-time low as FII outflows

Commenting on the policy environment, Soumya Kanti Ghosh, Chief Economic Adviser at the State Bank of India and a member of the Prime Minister’s Economic Advisory Council, said expectations of a rate cut had started to fade in recent weeks due to the rupee’s slide. He added that the RBI may now be entering a phase of prolonged pause, Hindustan Times reported.

The latest move reflects the RBI’s attempt to support growth at a time when inflation remains under control, even as currency volatility continues to pose risks to the broader economy.