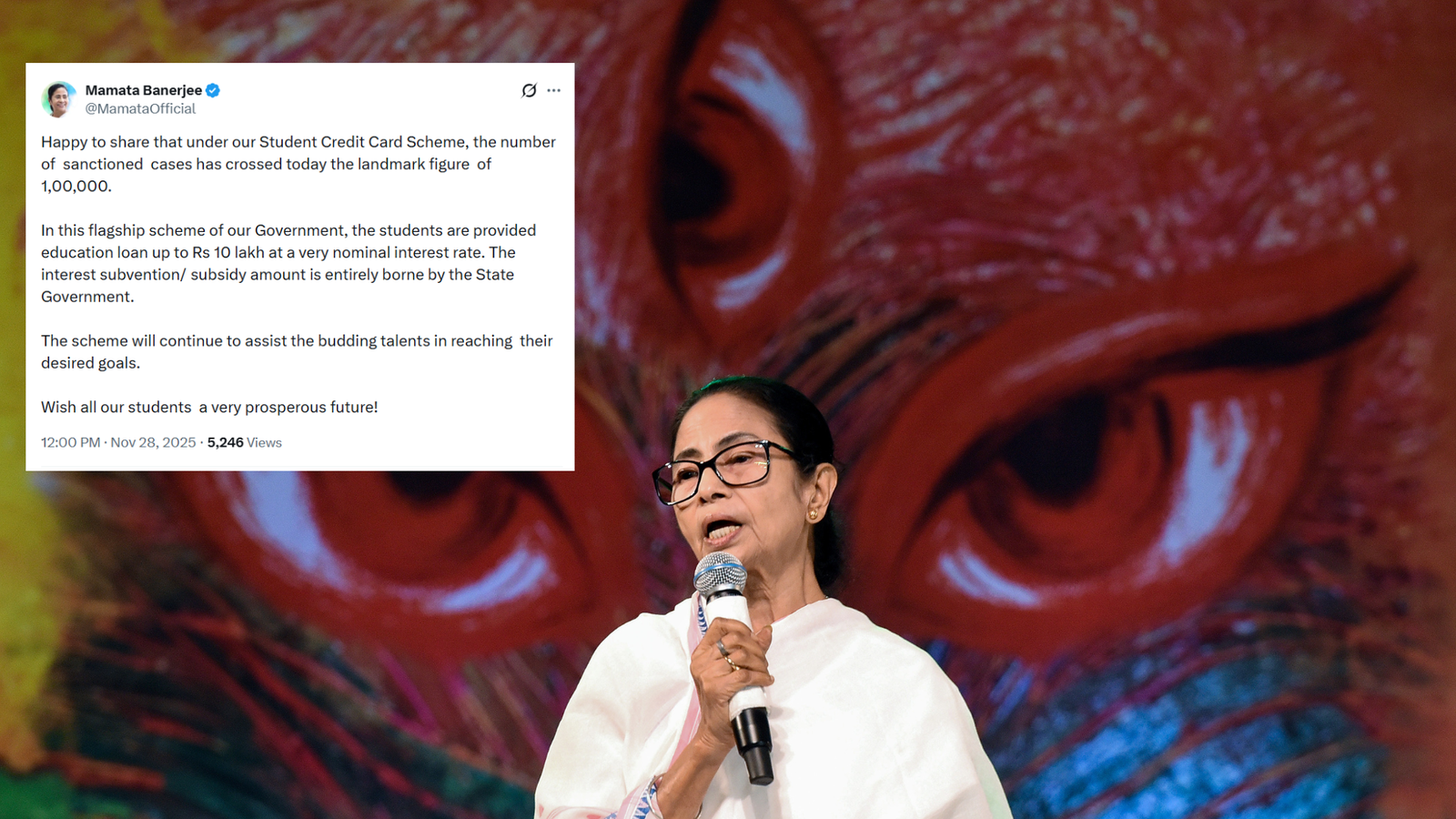

West Bengal Chief Minister Mamata Banerjee on Friday announced that the state's Student Credit Card Scheme has officially crossed 1,00,000 sanctioned cases, calling it a "landmark figure" for a programme aimed at easing the financial burden on students.

In a post on X, Banerjee said, “Happy to share that under our Student Credit Card Scheme, the number of sanctioned cases has crossed today the landmark figure of 1,00,000.”

Also Read | Jadavpur University opens applications for PhD admission under faculty of Arts

“In this flagship scheme of our Government, the students are provided education loan up to Rs 10 lakh at a very nominal interest rate. The interest subvention/ subsidy amount is entirely borne by the State Government”, she further added.

About the scheme

The Student Credit Card Scheme, rolled out on 30th June 2021, is one of the flagship programs undertaken by the Government of West Bengal. It supports students all over the state to pursue higher education without any economic constraints.

The scheme envisages an education loan of ₹10 lakh at a simple interest of 4% per annum for eligible students. The entire interest subvention/subsidy is borne by the state government, reducing the repayment burden significantly. Students who pay interest during the study period also receive an additional 1% concession.

Covers courses in India and abroad

The scheme covers a wide range of academic and professional pursuits. Students are eligible for loans for secondary, higher secondary, madrasah, undergraduate and postgraduate studies, along with professional degrees and equivalent courses. The facility also covers institutions both within India and abroad.

Candidates preparing for competitive exams like engineering, medical, law, IAS, IPS, and WBCS through coaching institutes are also eligible.

The loans are made available through the West Bengal State Co-operative Bank as well as affiliated Central Co-operative Banks, District Central Co-operative Banks, and a number of public and private sector banks.

Also Read | University of Calcutta holds meeting to find ways to increase class days

Flexible terms and wide eligibility

Applicants must not be more than 40 years old; thus, the scheme can accommodate a wide range of learners. Borrowers are allowed to repay the loan in a period of 15 years, including the moratorium period.

Reaffirming the commitment of the state, Banerjee said that the scheme would “continue to assist the budding talents in reaching their desired goals.”