In the final trading session of the week, the Indian stock market recorded solid gains. Along with the Sensex and the Nifty50, shares of a defence sector company moved sharply higher. During Friday’s session, Zen Technologies’ share price jumped 9.10 per cent to Rs 1,340.

The rally followed an exchange filing in which the company announced that it had received a new order from the Ministry of Defence. Market experts say this development played a key role in driving the sharp rise in the stock’s price.

Also Read | Gold and silver prices hit new highs despite minor Friday movements

Ministry of Defence places new order

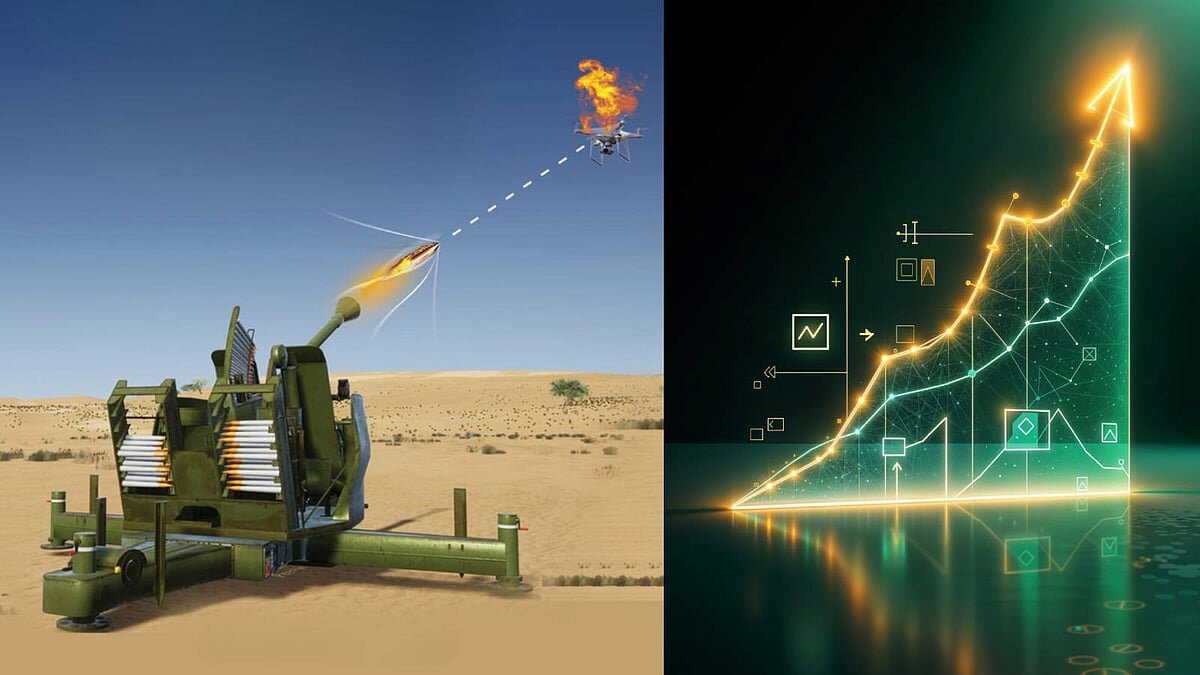

Zen Technologies has received a new order from the Ministry of Defence. This order is worth Rs 404 crore. Under this order, the company will manufacture anti-drone systems. Anti-drone systems will be developed to combat unmanned aerial systems. This is valued at Rs 332 crore. Training for this system and some necessary equipment will cost Rs 72 crore. It has been learned that this order is aimed at further modernising India's defence system.

The company's share price jumped following the anti-drone system manufacturing order. However, this stock's performance has not been good over the past year. In the last month, the price has declined by approximately 3.5 per cent. Over the past six months, this share's price has fallen by 28 per cent. In one year, this stock's price has decreased by more than 41 per cent. However, over the past five years, this stock has delivered nearly 1,300 per cent returns.

Also Read | Why is the rupee weakening for a third straight day amid strong dollar? Here's a detailed rundown

Market valuation and analysis

Despite the decline in share price, market analysts believe this company's stock valuation remains relatively high. This stock's price-to-earnings ratio is 45.03. The price-to-sales ratio stands at 13.7. Additionally, the Relative Strength Index (RSI) is below 30, which indicates an oversold condition. Therefore, while the new order has led to an increase in share price, market analysts remain uncertain about this stock's performance.

{News Ei Samay does not provide investment advice anywhere. Investment and trading in the share market or any field involve risk. Proper study and expert advice are recommended beforehand. This news is published for educational and awareness purposes.}