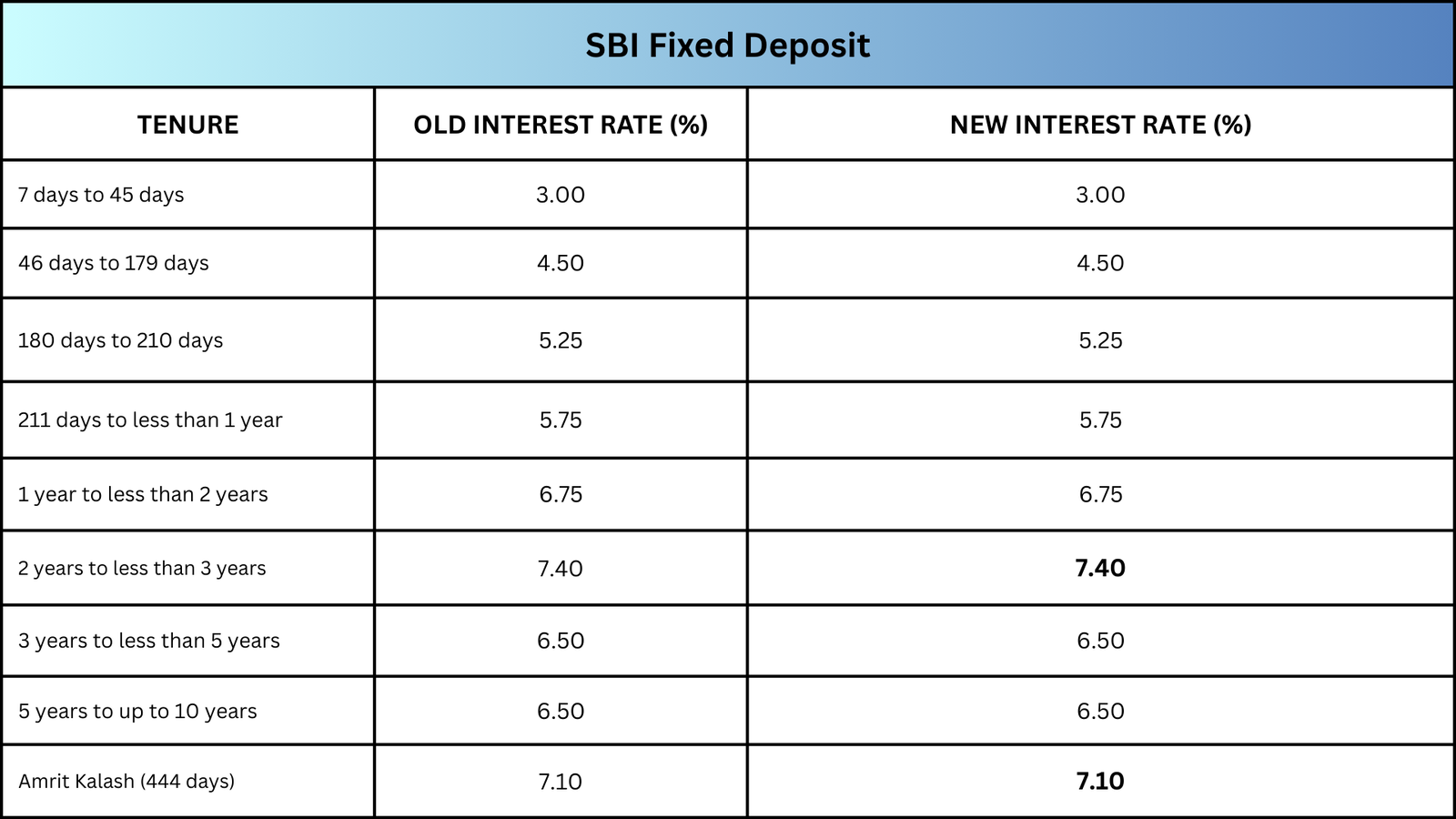

Interest rates on fixed deposits of State Bank of India. News Ei Samay

Interest rates on fixed deposits of State Bank of India. News Ei Samay State Bank of India (SBI) has made changes to interest rates in savings schemes like Fixed Deposit. The country's largest public sector bank has reduced interest rates on FD schemes of several tenures. This includes popular schemes like SBI Amrit Vrishti. The new interest rates will be effective from December 15. Detailed information in this regard has been provided on the bank's website.

Also Read | AI emerges as new nerve centre of brand strategy as businesses rethink value creation

The Reserve Bank of India announced a reduction of 25 basis points in the Repo Rate in the first week of December. Following this, the State Bank of India reduced interest rates on various loans. As a result, loan costs have decreased. Along with this, interest rates have also been reduced on schemes like Fixed Deposit, which are reliable for middle-class savings. SBI has made changes to interest rates multiple times since the beginning of this year.

Interest rates depend on the duration for which the Fixed Deposit is made, as in schemes of various banks. Among these, SBI was giving interest at a rate of 6.45 per cent on Fixed Deposits for a period of 2 to 3 years. From Monday, this will be reduced to 6.40 per cent. For senior citizens, the interest rate on this FD has been reduced from 6.95 to 6.90 per cent.

Also Read | A five-year market shock: 10 stocks that burned ₹66,600 crore of investor money

In the Amrit Vrishti Fixed Deposit scheme, general citizens used to get interest at a rate of 6.60 per cent. The tenure of this special FD scheme is 444 days. From December 15, the interest rate in this scheme has been reduced to 6.45 per cent. Senior citizens will now get interest at a rate of 7.05 per cent in this scheme.