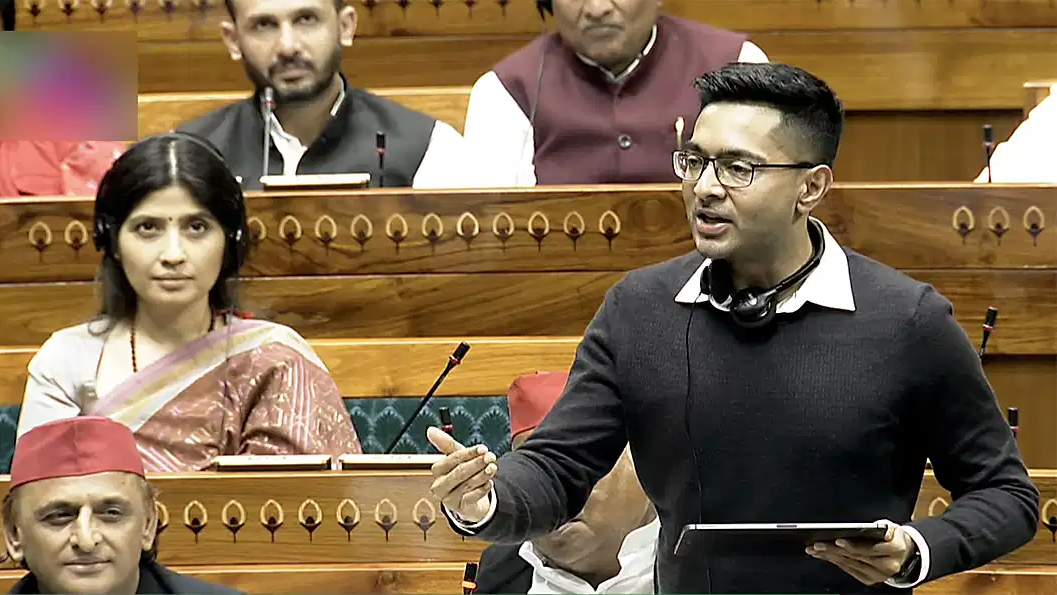

Trinamool Congress MP Abhishek Banerjee grabbed national headlines with his speech in the Lok Sabha on February 10, where he claimed that an Indian citizen pays taxes from birth to death, and that even their families continue to bear the burden after that.

He argued that taxation begins early in life, from milk in infancy to books during school years, and continues through income, savings, and everyday expenses.

Finance Minister Nirmala Sitharaman has since responded to his remarks, prompting a sharp counter from Abhishek Banerjee.

Nirmala Sitharaman responds to Abhishek Banerjee's speech

In response to Abhishek Banerjee's speech, Finance Minister Nirmala Sitharaman wrote on X, "There's no GST on education. Effectively, the GST is exempt. Pre-school to higher secondary education, there's no GST. Education leading to recognised qualifications, there's no GST. On books, textbooks & notebooks, there's no GST since 2017."

"On Healthcare services (treatment, diagnosis, care), I want to thank the members of the GST Council, there's 0% GST since 1st July, 2017. Health & Life Insurance on Individual plans was brought down to 0% in the Next Gen GST reforms (September 2025)," the Finance Minister added.

The Finance Minister also said that there was never any GST on funeral services.

Abhishek Banerjee launches sharp rebuttal

Responding to the Finance Minister's post on X, Abhishek Banerjee wrote, "I thank Hon'ble Finance Minister for so carefully listening to my speech. Though I wish she'd listen as carefully to the people of Bengal when they ask for their MGNREGA, PMAY, PMGSY and JJM dues. The Finance Minister says I 'twisted facts.' Let me untwist them for her."

Abhishek Banerjee went on to counter the Finance Minister's response, point-by-point. He wrote, "She's absolutely right, there's no GST on fresh liquid milk. But perhaps she hasn't seen the mother who can't afford fresh milk, who stretches her budget by mixing powdered milk for her infant. That powdered milk? 5% GST. Zero tax on what she can't buy, 5% tax on what she's forced to buy."

On GST levied upon notebooks, Banerjee wrote, "She's correct again, textbooks have no GST. But the graph paper a student uses for his/her math assignment? 12% GST. The laboratory notebook for the science practical? 12% GST. The crayons for the drawing class? 12% GST."

I thank Hon'ble Finance Minister @nsitharaman for so carefully listening to my speech. Though I wish she'd listen as carefully to the people of Bengal when they ask for their MGNREGA, PMAY, PMGSY and JJM dues. The Finance Minister says I 'twisted facts.' Let me untwist them for… https://t.co/bpEGPQ5SXj pic.twitter.com/awa2frEFFW

— Abhishek Banerjee (@abhishekaitc) February 12, 2026

"On healthcare, she's technically accurate as always; consultation and treatment are GST-free. But the oxygen cylinder that keeps a COVID patient alive? 12% GST. The insulin injection that prevents a diabetic from dying? 5% GST. The anesthesia for the surgery? 12% GST," Abhishek Banerjee added.

Abhishek Banerjee said that 'even grief has a price tag in 'New India'. He wrote, "And yes, funeral services are exempt. But the agarbatti we light for our departed? 5% GST. EVEN GRIEF HAS A PRICE TAG IN 'NEW INDIA.'"

"This, Honourable Finance Minister, is EXACTLY the problem I was highlighting. Until you understand the difference between what's written in the GST Act and what's written on a poor family's grocery bill, you'll keep living in your India while we live in ours. Thank you for proving my point better than I ever could," Banerjee concluded.