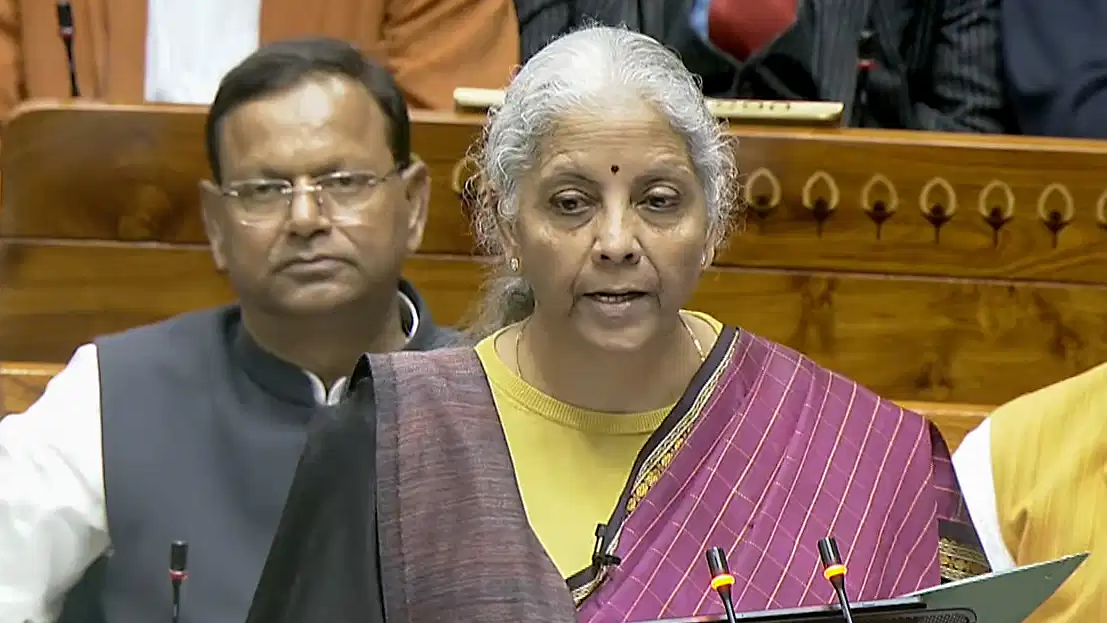

Finance Minister Nirmala Sitharaman, while presenting the Union Budget 2026–27 in Parliament on February 1, announced a key liberalisation measure for non-resident investors, proposing higher limits for equity investments by persons resident outside India through the portfolio route.

This is the ninth Union Budget presented by Sitharaman and includes changes aimed at widening participation in India’s capital markets while reducing dependence on foreign portfolio investors.

Also Read | What is Mahatma Gandhi Handloom Scheme? FM Nirmala Sitharaman pushes textile reforms in Budget

Higher caps for NRIs and overseas Indians

Under existing rules, non-resident Indians (NRIs) are allowed to invest in Indian listed equities, but such investments are capped as a percentage of a company’s paid-up capital. The Budget proposes a significant relaxation of these limits.

The overall investment limit for Persons of Indian Origin (PIOs) has been raised from 10% to 24%. Individual investment caps have also been enhanced, allowing greater room for overseas Indians to build equity exposure in Indian companies.

“The overall limit NRI can invest in an Indian company through the portfolio scheme has been increased from 10% to 24%,” said Neeraj Agarwala, Partner at Nangia & Co LLP, explaining the Budget proposal.

What changes for persons resident outside India

The Budget also addresses investments by persons resident outside India (PROI), a category defined under the Foreign Exchange Management Act (FEMA). A PROI includes NRIs, foreign nationals, overseas entities, and offices or branches located outside India that do not meet India’s residency criteria.

For PROI investors in listed Indian equities, the individual investment limit has been raised from 5% to 10%, while the aggregate cap now stands at 24%, up from 10%.

According to Sanjay Kumar, Director at Nangia Global Advisors LLP, the move strengthens ease of doing business. “Allowing persons resident outside India to invest in listed equities via the portfolio route, while doubling individual caps and raising aggregate limits, will deepen markets and support stronger foreign investment inflows,” he said.

Also Read | Union Budget 2026: FM announces simpler tax norms, new IT Act from April 1, 2026

Expected impact on capital markets

Market experts say the liberalisation could reduce India’s reliance on foreign portfolio investment while encouraging long-term participation from overseas Indians.

By expanding the pool of eligible investors and raising caps, the government expects deeper liquidity in equity markets and broader participation from the Indian diaspora.