Finance Minister Nirmala Sitharaman announced the Union Budget for 2026-27 in the Parliament today. She said that spending on infrastructure will hit a new high in the next financial year. The government will spend a record Rs. 12.2 lakh crores in the sector, starting April 1.

The new outlay is higher than before. It marks an 8.8 per cent rise over the Rs. 11.21 lakh crore set aside for the current year, which itself was the highest allocation on record.

Sitharaman's infrastructure push

The Finance Minister said, "Public capex has increased manifold from Rs. 2 lakh crore in FY2014-15 to an allocation of Rs. 11.2 lakh crore in BE 2025-26. In FY2026-27, I propose to increase it to Rs. 12.2 lakh crore to continue the momentum."

FM Sitharaman added, "During this past decade, our government has undertaken several initiatives for large-scale enhancement of public infrastructure, including through new financing instruments such as Infrastructure Investment Trusts (InVITs) and Real Estate Investment Trusts (REITs) and institutions like NIIF and NABFID. We shall continue to focus on developing infrastructure in cities with over 5 lakh population (Tier II and Tier III), which have expanded to become growth centres."

Also Read | Budget 2026 proposes SHE retail outlets to boost women-led businesses

What do business leaders say?

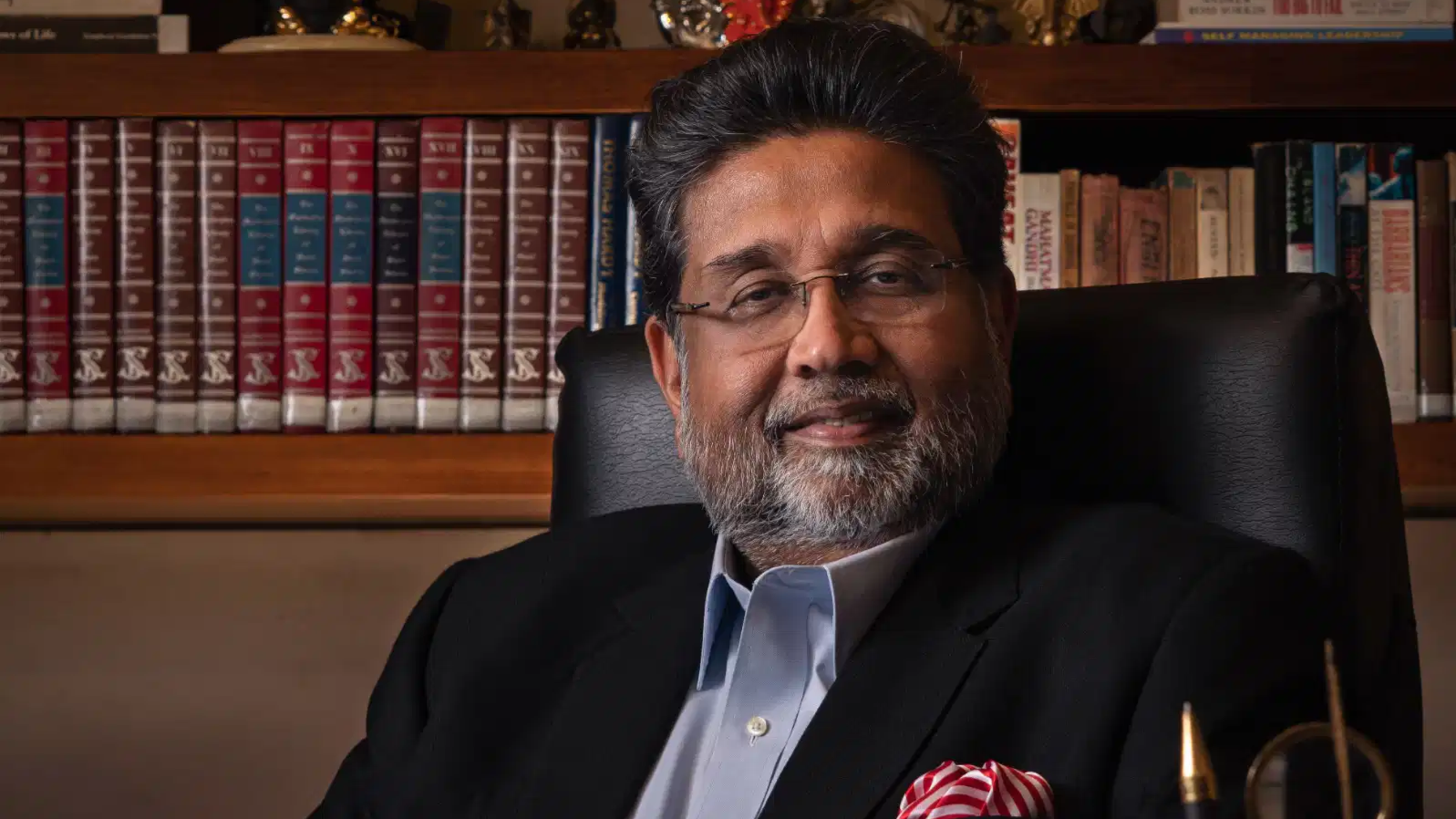

Ambuja-Neotia Group Chairperson Harshvardhan Neotia shared his reaction on the Finance Minister's infrastructure push. He said, "The Union Budget 2026 demonstrates the government's continued commitment to transforming India's urban landscape through infrastructure-led growth. The 8.9% increase in capital expenditure to Rs. 12.2 lakh crore is a welcome step that will sustain momentum in large-scale development and create substantial opportunities across the construction and real estate value chain."

"The introduction of dedicated REITs for CPSE asset monetisation and the Infrastructure Risk Guarantee Fund are progressive measures that will de-risk capital deployment and attract both domestic and international investors. These initiatives signal a maturing ecosystem for institutional real estate investment," he added.

Also Read | Budget 2026 opens wider door for NRIs, raises equity investment limits

Mr Neotia further said, "The Rs. 5,000 crore allocation per City Economic Region and the continued focus on Tier-2 and Tier-3 cities with populations over 5 lakh is strategically sound. These emerging centres represent India's next growth frontier, and the extension of AMRUT to smaller towns will create a more inclusive development framework."

"Overall, this is a budget that lays a strong foundation for sustained sectoral growth, though calibrated demand-side measures in future policies would help unlock the full potential of India's real estate market," he concluded.