According to the Economic Survey for the 2025–2026 financial year, India's economy may grow at a rate of 7.4 per cent in the 2026 financial year (FY26). In the 2027 financial year (FY27), the GDP growth rate may decline slightly to between 6.8 and 7.2 per cent. Regulatory reforms, strong macroeconomic conditions, and increased private sector investment have emerged as the key driving forces behind this growth in the central government's financial survey.

Economic survey tabled in Parliament

Finance Minister Nirmala Sitharaman presented the Economic Survey in Parliament on Thursday. This survey was prepared under the supervision of Chief Economic Adviser V. Anantha Nageswaran. The survey outlines how India will manage its economy amid high American tariffs, international uncertainty, and the risks of AI-dependent growth.

The forecast of 7.4 per cent growth for the current financial year closely aligns with the International Monetary Fund (IMF)'s 7.3 per cent and the World Bank's 7.2 per cent estimates. For the next financial year, the IMF and World Bank have projected GDP growth at 6.4 per cent and 6.5 per cent, respectively. This indicates that economic growth momentum may slow down somewhat in the following year.

Also Read | Why India’s two-wheeler industry is betting big on the India–EU trade deal

Key reforms driving economic momentum

The Survey highlights several recent reforms, including:

GST rationalisation and income tax exemptions

A simplified Direct Tax Act is scheduled for implementation from April

Liberalised FDI policies

Amendments to the bankruptcy law framework

These measures, along with higher infrastructure spending, are aimed at boosting private investment and job creation.

AI bubble risks and global uncertainty

Using quotes from the IMF's World Economic Outlook, the survey states that if a potential 'AI bubble' forms, market corrections may occur. This could reduce capital flows and increase pressure on household wealth. These risks have also been mentioned in the Economic Survey report.

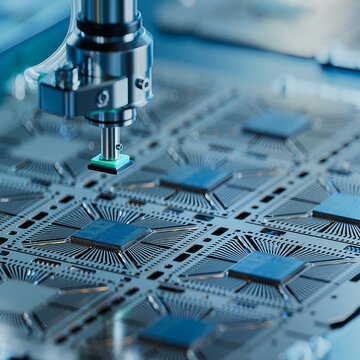

India's roadmap for the manufacturing sector includes global supply diversification, product quality improvement, and expanding commercial partnerships. The government is also focusing on self-reliance in semiconductors and other critical sectors.

Also Read | What do MSMEs expect in Union Budget 2026? Concerns, expert insights and more

The report states that inflation is currently under control. The Reserve Bank of India has forecast CPI inflation to remain within 2 per cent this year. This relief has come due to corrections in food prices. However, due to low inflation, the nominal GDP growth rate has dropped to around 8 per cent, which is lower than the budget target of 10.1 per cent.

The report reveals that public capital expenditure is increasing rapidly. While the expenditure was 5.93 lakh crore rupees in the 2022 financial year, it has increased to 11.21 lakh crore rupees in the 2026 financial year. This expenditure now accounts for approximately 3.1 per cent of GDP. However, the survey states that to achieve the development goals of 2047, private investment must increase significantly alongside public expenditure.